MEDIA STATEMENT

CAHYA MATA REPORTS IMPROVED FINANCIAL RESULTS FOR 2022 TURNOVER SURPASSES RM1 BILLION MARK

-

FY2022's PBT increased by 76% as compared to FY2021

-

Turnover surpasses the RM1 billion mark

-

Improved Divisional performance from Cement and Road Maintenance for FY2022

-

PATNCI registers a 46% growth on Y-o-Y basis

-

Proposed First & Final tax-exempt dividend of 3 sen per share

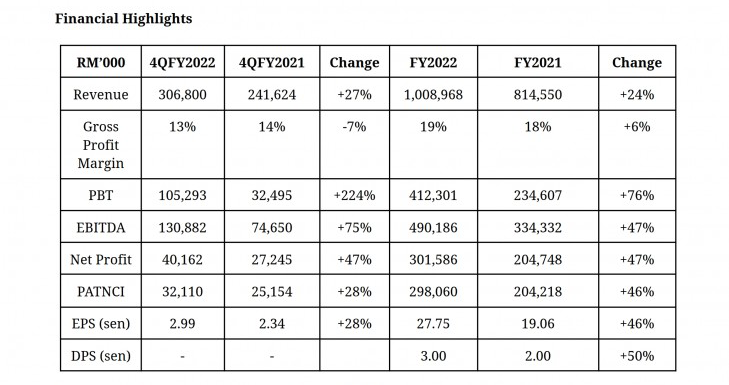

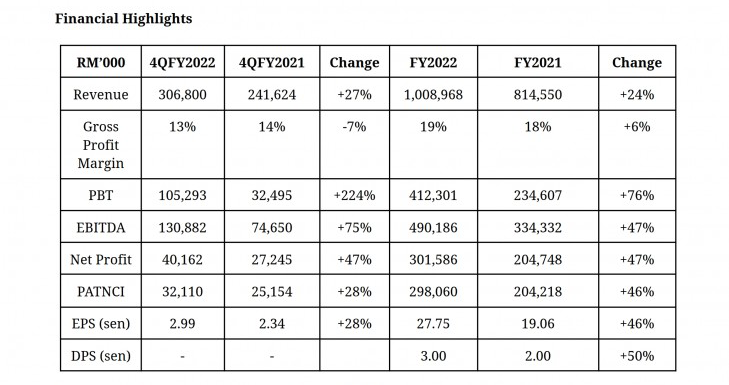

Kuching (Sarawak), Monday, 27 February 2023 - Cahya Mata Sarawak Berhad ("Cahya Mata" or "the Group") is pleased to announce its financial results for the year ended 31 December 2022 ("FY2022"). The Group reported total revenue of RM1.01 billion for FY2022, representing an increase by 24% in comparison to the preceding year's ("FY2021") revenue of RM814.55 million. Cahya Mata's revenue increased in FY2022 due to higher contributions from its Cement and Road Maintenance Divisions.

The Group's profit before tax ("PBT") improved by 76% to RM412.30 million as compared to RM234.61 million in FY2021; operational profits increased on better margins. PBT improvements were also due to the negative goodwill of RM71.07 million arising from the acquisition of Oiltools group and the reversal of impairment of RM37.69 million on investment and the gain on disposal of associates of RM89.02 million.

The Group's profit after tax and non-controlling interests ("PATNCI") for FY2022 increased by RM93.84 million, representing an increase by 46% to RM298.06 million in comparison to RM204.22 million reported in FY2021.

Business Segment Performance

Cement Division reported a 30% higher PBT of RM80.22 million in FY2022 over FY2021's PBT of RM61.65 million mainly attributable to higher sales.

Trading Division reported a PBT of RM2.36 million, a decrease of 61% in comparison to FY2021's PBT of RM6.11 million. The lower PBT in FY2022 was due to a higher overall material price and lower sales volume.

Road Maintenance Division reported a PBT of RM17.11 million, an increase of 78% in comparison to the preceding year's corresponding period PBT of RM9.59 million. The higher PBT was mainly attributable to an increase in work orders and improved operational efficiencies.

Property Development Division reported a slightly higher PBT of RM33.17 million in FY2022 in comparison to a PBT of RM32.43 million in FY2021 as the opening of the economy helped to improve the demand for properties.

Oiltools Division reported a PBT of RM73.36 million on a Year to Date (YTD) basis reflecting the consolidation of financial results effective from the completion date of the Group's acquisition of Scomi Oilfields as of September 2022.

Share of results of associates reported a decrease in profit to RM139.11 million in FY2022 as compared to RM166.73 million reported in FY2021. Profit contributions from associate companies were lower in FY2022 as compared to FY2021, mainly due to the disposal of shares in OM Materials (Sarawak) Sdn Bhd during the year and lower performance from an associate company.

Dividend

The Board has Proposed First & Final tax-exempt dividend of RM0.03 per share. The dividend entitlement and payment date for the final dividend will be announced at a later date.

Strong Balance Sheet Fundamentals

As at FY2022, total assets stood at RM4.91 billion while shareholders' funds grew to RM3.23 billion. The Group returned to a net cash position of RM427.55 million for FY2022 from a net debt position of RM352.83 million for FY2021.

Prospects

Despite the challenges of increased logistical and raw materials prices, Cahya Mata Group improved its operational performance for FY2022. This was through improved operations management and effective marketing.

The Board of Directors continue to hold a longer-term view that infrastructure and rural development activities will remain active. Cahya Mata's group of companies should benefit from the strong economy in Sarawak.