Corporate Milestones

Since our humble beginnings in 1974, Cahya Mata has experienced a myriad of significant milestones and achievements.

Our company history represents a rich tapestry of events and changes that have culminated in today’s Cahya Mata – a diversified, listed corporation with a synergised portfolio of over 35 companies, spread across six divisions.

-

Established as Cement Manufacturers Sarawak Sdn Bhd

Sarawak State Financial Secretary Tan Sri Datuk Amar Haji Bujang Mohd Nor called the meeting to attention. With him in his office in the Secretariat Building, Kuching, was Datuk Haji Mohd Amin Satem, Executive Chairman of the Sarawak Economic Development Corporation (SEDC) and four others: Datuk Haji Yahya bin Haji Lampong and Philip Lee, both from the Sabah Economic Development Corporation (SEDCO), and Peter Koh and Nicholas Gunjew of the SEDC. It was 9.00 a.m. on Thursday, 31 October 1974. This was the first Board of Directors’ meeting of Cement Manufacturers Sarawak Sendirian Berhad. The company had been incorporated a little over three weeks earlier, on 8 October 1974, with its registered address at the 2nd floor of the Electra House building, Power Street, Kuching. Cahya Mata was jointly owned on a 50-50 basis by the SEDC and SEDCO, with Tan Sri Datuk Amar Haji Bujang Mohd Nor and Datuk Haji Mohd Amin Satem its original directors.

-

Commenced Manufacturing of Ordinary Portland Cement at Sarawak’s 1st Cement grinding plant

On 12 January 1978, in a simple ceremony witnessed by some 40 invited guests and 79 employees, Sarawak’s then Chief Minister – the late Tun Datuk Patinggi Abdul Rahman Ya’kub – turned the knob to start Borneo’s first cement grinding plant, located at the Pending Industrial Estate. The Chief Minister was elated that the State could now depend on local resources and manpower to develop the much-needed housing industry, which was slowly growing. Speaking at a press conference following the opening of the plant, Managing Director, Datuk Haji Amin Satem said that, “with the setting up of the plant, a stable price of the commodity is assured.” Up until then, the cement price had fluctuated depending on the source of shipment. Once the Cahya Mata plant was established, the local production price was fixed by the Federal Ministry of Domestic Trade.

-

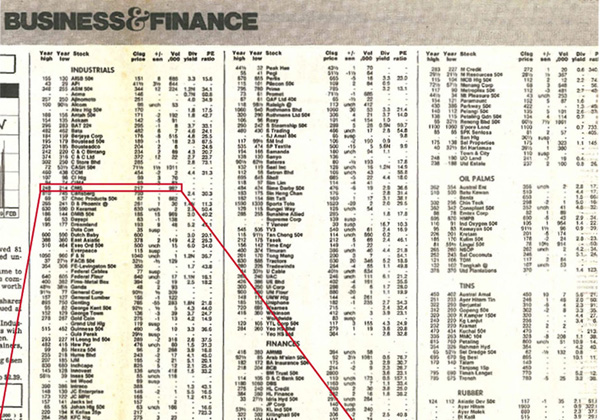

Listed on the Main Board of Bursa Malaysia

On 2 February 1989, Cahya Mata’ shares were listed on the Kuala Lumpur Stock Exchange Main Board. The shares had been over-subscribed by more than 20 times. On its opening day, it reached a high of RM2.48 per share – compared with the offer price of RM1.30 – before ending the day at RM2.17. This was the first time a Sarawakian company had been listed on the Main Board.

-

Rapid business expansions via acquisition of infrastructure related businesses

The Cahya Mata Board incorporated two subsidiaries – Cahya Mata Cement Sdn Bhd and Cahya Mata Properties Sdn Bhd. Cahya Mata acquired stakes in three Sarawak Economic Development Corporation subsidiaries – Sara Kuari Sdn Bhd, including PPES Works (Sarawak) Sdn Bhd and PPES Premix Sdn Bhd; Steel Industry Sarawak Bhd; and PCahya Mata Sdn Bhd. Cahya Mata’ infrastructure business expanded with the acquisition of Jabatan Kerja Raya’s premix plants, and constructed new plants. In 1994, the Cahya Mata Board recognised the need to centralise all shipping matters through Archipelago Shipping (Sarawak) Sdn Bhd. The transaction proceeded in 1996, and Archipelago Shipping was renamed as Cahya Mata Transportation Sdn Bhd. In November 2001, however, Achi Jaya Services Sdn Bhd offered to acquire Cahya Mata Transportation Sdn Bhd for RM30 million and the proposed disposal was completed in January 2003.

-

Adopted current name – Cahya Mata Sarawak Berhad

Following a period of rapid diversification, on 15 December 1996, the Cahya Mata Board agreed to change the company’s name from Cement Manufacturers Sarawak Berhad to Cahya Mata Sarawak Berhad, subject to approval from the Sarawak State Secretary’s Office. This was obtained in a letter dated 5 March 1996, and the change was officially made on 13 June 1996. ‘Cahya Mata’ in Malay refers to a special child or literally ‘apple of the eye.’ Thus Cahya Mata Sarawak can mean ‘Sarawak’s favourite son.’ This concept has been further extended through Cahya Mata’ then vision statement, "To be the PRIDE of Sarawak and Beyond". The Cahya Mata logo was also changed from the angular blue design to one comprising the colours of the Sarawak flag: yellow, red and black. The interlocking shapes of the logo reflect the concepts of yin and yang and represent the Group’s two main divisions at the time: infrastructure and investment.

-

Merge futures & stockbroking businesses with K&N Kenanga Holdings

On 26 December 2000, Cahya Mata Capital Sdn Bhd entered into an exchange agreement with Peninsular Malaysia-based stockbroker K&N Kenanga Holdings Berhad to transfer Cahya Mata’ securities and futures business to K&N Kenanga in return for shares in K&N Kenanga. Cahya Mata’ subsidiaries Sarawak Securities Sdn Bhd and Sarawak Securities Futures Sdn Bhd were sold to K&N Kenanga in August 2001. The merger enabled the latter to achieve Universal Broker status in line with the government’s call for consolidation of the country’s stockbroking industry. The merger resulted in Cahya Mata, through Cahya Mata Capital Sdn Bhd, holding just over 25% in the enlarged K&N Kenanga – one of the largest retail-based stockbroking companies in Malaysia – and becoming the single largest shareholder. Cahya Mata continues to hold this stake as one of its strategic investments.

Restructured financial services business

The financial services business was one that had then complemented the Group’s banking business. This business unit was restructured after the merger of Cahya Mata Capital Sdn Bhd and K&N Kenanga Holdings Berhad. Previously, Cahya Mata Capital Sdn Bhd was the holding company of Sarawak Securities Sdn Bhd (SSSB) and Sarawak Securities Futures Sdn Bhd; SSSB was the first licenced stockbroker in Sarawak and commenced operations in 1992 as a member company of the Kuala Lumpur Stock Exchange. Through the merger, Sarawak Securities Futures Sdn Bhd and SSSB were sold to K&N Kenanga. The financial business, which was under Cahya Mata Capital Sdn Bhd then restructured and housed Cahya Mata Trust Management Sdn Bhd; K&N Kenanga Holdings Bhd; Cahya Mata Dresdner Asset Management Sdn Bhd, a joint venture between Cahya Mata Group and the Dresdner Group; and Cahya Mata Mezzanine Sdn Bhd, which executed mezzanine and related financing activities.

-

Acquired RHB

During the course of 1999, 2000, and 2001, in line with Bank Negara’s policy of consolidating Malaysia’s banking industry, Cahya Mata subsidiary, Utama Banking Group (UBG) took part in merger proposal negotiations. The first prospective partner was PerwiraAffin Bank Bhd, but this did not materialise. The second was Arab Malaysian Bank Berhad (AMBB), with whom UBG went to the extent of signing a Sales and Purchase Agreement, but that also didn’t cross the line after AMBB sought to make changes to the agreement. Next, it talked to EON Bank but nothing came to fruition. UBG then embarked on a fourth set of merger talks, this time with Rashid Hussain Bhd (RHB), Malaysia’s third largest banking group. UBG set out to merge with RHB, and announced the successful completion of merger talks on 20 March 2002. On 1 May 2003, RHB Bank Bhd officially merged with Bank Utama and formed the RHB Group.

-

Disposal of RHB

Following several months of negotiations with potential bidders for its 32.8% stake in Rashid Hussain Bhd (RHB), a Cahya Mata subsidiary, Utama Banking Group (UBG) announced on 8 March 2007 that its Board had accepted a revised offer of RM2.25 billion from the EPF (Employees Provident Fund), subject to shareholder and regulatory approvals. This resulted in a net gain for UBG and the deal made EPF the largest shareholder in RHB Berhad. Following UBG’s disposal of its stakes in RHB, Cahya Mata was reclassified by Bursa Malaysia from ‘Finance’ sector to the ‘Industrial Products’ sector.

Acquired Sarawak Clinker

At a simple ceremony in Kuala Lumpur on 30 August 2007, Cahya Mata Cement Sdn Bhd signed a share purchase agreement to buy 100% equity in Sarawak Clinker Sdn Bhd, 33% from Mirzan Mahathir and 67% from Maybach Investment Co., which was represented by Raymond Ang of the Philippines-based conglomerate, San Miguel Group. The decision to buy Sarawak Clinker Sdn Bhd was based on the desire to make Cahya Mata Cement a more efficient, low-cost integrated cement producer. By having its raw material supplied in-house, Cahya Mata Cement became able to better ensure the quality and reliability of its product mix beyond Portland Cement. Cahya Mata acquired Sarawak Clinker in November 2007 for RM110.0 million on a willing-buyer-willing-seller basis. The plant had an annual rated production capacity of 800,000 MT per year and produced an average of 2,500 MT of clinker per day. It remains East Malaysia’s sole producer of clinker. In 2008, Sarawak Clinker Sdn Bhd was renamed Cahya Mata Clinker Sdn Bhd. Next to the clinker plant at Mambong are Cahya Mata Clinker’s own quarrying concessions of key raw materials – limestone, shale and sandstone – covering 78 hectares. Under Cahya Mata, a team of 260 staff operates the clinker plant in three shifts per day. Following its acquisition of the plant, Cahya Mata spent RM70.0 million from 2012-2013 to increase its capacity to 900,000 MT a year and enabled it to be fuelled by locally sourced lower-calorific- value coal as opposed to higher-calorific-value coal, which would need to be imported at a higher cost.

Acquired 20% stake in KKB Engineering

In November 2007, Cahya Mata finalised the sale of the site of Cahya Mata Steel Sdn Bhd’s rolling mill to Bursa Malaysia-listed KKB Engineering Bhd (KKB) for a disposal price valued at RM32.0 million. The sale of the 17.6–acre site fronting the Sarawak River at Sejingkat, Kuching was to be satisfied by KKB through the issuance of 16 million new ordinary shares, giving Cahya Mata a strategic 20% stake in KKB. KKB Group Chairman and Managing Director Dato Kho Kak Beng, whose initials form the name of the company he founded, said that the signing marked the beginning in KKB’s ambition to expand further within Sarawak and beyond, targeting its strength of structural steel fabrication and related engineering works, and to undertake steel works for more Cahya Mata and third-party projects in the future. KKB is also involved in the manufacturing of LPG cylinders and cylindrical steel drums.

-

Disposal of Cahya Mata Roads and Cahya Mata Pavement Tech to UBG Bhd

On 2 July 2008, Utama Banking Group’s (UBG) acquisition of Cahya Mata Roads Sdn Bhd and Cahya Mata Pavement Tech Sdn Bhd was completed with the allotment of 44,652,000 new UBG shares to PPES Works (Sarawak) Sdn Bhd and the payment of a cash consideration of RM23.37 million to Sarawak Economic Development Corporation. Cahya Mata Roads and Cahya Mata Pavement Tech then became wholly-owned subsidiaries of UBG.

-

Disposal of UBG Bhd

In order to focus more clearly on its key businesses, Cahya Mata sought to dispose of its stake in Utama Banking Group (UBG). Before doing so however, in May 2009, UBG disposed of Cahya Mata Roads Sdn Bhd and Cahya Mata Pavement Tech Sdn Bhd to its listed subsidiary Putrajaya Perdana Bhd. On 29 December 2009, it was announced that Petro Saudi International Ltd, a privately owned investment holding company with its headquarters in Saudi Arabia, proposed to acquire Cahya Mata’ stake in UBG. The transaction was completed in September 2010. Cahya Mata’ 37.21% stake in UBG, which it held through its wholly owned subsidiary Concordance Holdings Sdn Bhd and PPES Works (Sarawak) Sdn Bhd, (in which it held a 51% stake), realised an immediate cash return for Cahya Mata and its subsidiaries of more than RM465.0 million.

Ceased Operations of loss making IT companies

Cahya Mata realised that its momentum would be better maintained without involvement in this aspect of the information, communication and technology (ICT) sector. It had originally entered into a share sale agreement with local information technology company I-Systems Group Bhd in early 2005 for the acquisition of shares amounting to just over RM18.0 million, representing a 51% equity interest in the MSC-status company. It was thought at the time that this would strengthen Cahya Mata’ foray into the ICT sector by leveraging on I-System Group’s experienced R&D team, capabilities in developing and marketing, and cross-selling of new products. However, this did not turn out to be the case. So, in 2010, Cahya Mata made the difficult decision to cease the operations of its technology subsidiary, Cahya Mata I-Systems Berhad, which had incurred considerable losses for some time. The subsidiary’s employees were retrenched with compensation and parts of its business sold off.

-

Re-acquired Cahya Mata Roads and Cahya Mata Pavement Tech

On 4 May 2011, Cahya Mata held an extraordinary general meeting (EGM) at the Riverside Majestic Hotel in Kuching to seek approval for the re-acquisition of both Cahya Mata Roads Sdn Bhd and Cahya Mata Pavement Tech Sdn Bhd from Putrajaya Perdana Bhd. After months of negotiations and discussions by numerous consultants, financiers and Cahya Mata management teams, the EGM took less than 10 minutes to convene and made a unanimous decision in approving the proposal. Two days later, the re-acquisition exercise of the companies by wholly owned Cahya Mata subsidiary Cahya Mata Works Sdn Bhd from Putrajaya Perdana Bhd for RM82.0 million was completed. In addition to having a positive impact on Cahya Mata’ earnings, the acquisition returned additional expertise in road construction and road maintenance to Cahya Mata, enabling it to maximise potential earnings by securing more infrastructure-related projects.

-

Signed Power Purchase Agreement and Joint Venture Agreement for OM Materials (Sarawak) to build and operate a Ferrosilicon and Manganese Ferroalloys Smelter

In 2011, Cahya Mata announced that it was exploring investment in ferrosilicon and manganese smelting at the Samalaju Industrial Park (SIP). Later, Cahya Mata’ wholly owned subsidiary Samalaju Industries Sdn Bhd signed a Memorandum of Understanding (MoU) with OM Materials (S) Pte Ltd (OMS), a wholly owned subsidiary of OM Holdings Ltd (OMH), one of the world’s largest manganese ore producers, which is listed on the Australian Stock Exchange (ASX). This related to the proposal to develop an approximate USD592.0 million smelting plant capable of producing 600,000 MT of manganese and ferrosilicon per year. In 2012, then Chief Minister Tun Pehin Sri Haji Abdul Taib Mahmud officiated at the signing ceremony of the joint venture. Formed in 2013, Cahya Mata Group has a 20% equity stake in OM Materials Sarawak and OM Materials Samalaju while the remaining 80% is owned by OMH. In March that year, OM Sarawak secured full funding for its ferrosilicon production facility (Phase 1) with the sealing of a financing facility worth USD315.0 million (RM970.0 million) with four local and foreign lenders. The banks were the Export-Import Bank of Malaysia Bhd, RHB Bank Bhd, Standard Chartered Bank Malaysia and Malayan Banking Bhd. Standard Chartered is OM Sarawak’s financial advisor in the smelting project. OMH announced to the ASX that capital expenditure on Phase 1 was estimated to be USD397.0 million. As part of OM Sarawak’s obligations under the power purchase agreement with Syarikat Sesco Bhd, a unit of Sarawak Energy Bhd, it has issued Sesco with a performance and payment guarantee and Sesco will supply 500 MW (per annum) to OM Sarawak for 20 years.

-

Signed Joint Venture Agreement and Power Purchase Agreement Term Sheet for Malaysian Phosphate Additives (Sarawak) to build and operate an Integrated Phosphate Plant in Samalaju

There is growing demand for phosphorus, an essential base nutrient widely used in food, feed and fertiliser products. Cahya Mata had joined forces to build an integrated phosphate complex at Samalaju at a projected cost of RM1.04 billion. On the last day of 2013, Samalaju Industries Sdn Bhd entered a shareholders’ agreement with Malaysian Phosphate Venture Sdn Bhd (MPV) and Arif Enigma Sdn Bhd (AESB) to form a joint venture company called Malaysian Phosphate Additives (Sarawak) Sdn Bhd (MPAS). Samalaju Industries Sdn Bhd and MPV will each own 40% of MPAS while AESB will own 20%. On 8 January 2014, MPAS signed a Power Purchase Agreement (PPA) with Sarawak Energy Berhad for the supply of 150 MW of electricity. The complex is the first of its kind in Malaysia and indeed Southeast Asia, and is the first non-metal or alloy-based plant in Samalaju Industrial Park (SIP), taking SCORE and Cahya Mata into a dynamic new industrial sector that offers long-term sustainable demand growth. The complex will have an annual production capacity of 500,000 tonnes of food and feed phosphate and related products such as fertiliser phosphate derivatives. It will be built on a 142-hectare site near the Samalaju deep water port, which is under construction. Construction started in the first quarter of 2014 and the complex is expected to be operational by 2017, and fully commissioned in 2018. Nearly 1,000 skilled workers and staff will be employed.

Cahya Mata joins the list of Malaysia’s Top 100 market cap companies

In 2013, Cahya Mata increased its Investor Relations (IR) activities which included an increase in shareholder meetings, private meetings with the financial community and participation in investment related conferences. As the senior management had then felt that the company had rationalised its businesses to focus on key competencies within Sarawak and SCORE, there was a genuine story to share with the financial/investment community. The IR initiative proved to be extremely successful, and, before the turn of the year, the Group’s rank went up in terms of Market Capitalisation, becoming one of Malaysia’s Top 100 companies, benefiting its then existing shareholders and also its employees who had held shares via the Employee’ Share Options Scheme (ESOS). Around the same time, Cahya Mata started to grow in popularity with the investment community and its IR unit met with representatives (i.e. analysts, fund managers, research houses) from around the globe. Cahya Mata’ share price closed at RM6.87 on 31 December 2013; in comparison its share price had opened at RM3.32 at the beginning of the year on 2 January. Cahya Mata has since maintained its standing as a Malaysian Top 100 market cap company.

-

Cement Division signed EPC Agreement for new Cement Grinding Plant

Cement Division signed the Engineering, Procurement and Construction (EPC) Agreement with Christian Pfeiffer Maschinenfabrik GmbH for the development of a new grinding project at Mambong. The RM190.0 million integrated plant will have an annual rated production capacity of 1.0 million MT and will increase cement production capacity by almost 60%.

OM Sarawak’s first production achieved

At around midnight on 22 September 2014, the first phase of commercial production was achieved when the ferroalloys were successfully tapped at around midnight (Sarawak time) at OM Sarawak’s Ferrosilicon and Manganese alloys smelting project in Samalaju Industrial Park (SIP). By the end of 2014, four furnaces were in operation. To mark this historic event, the first ferrosilicon slab to be tapped was removed and is kept in OM Sarawak’s office in SIP as an emblem.

Cahya Mata 40th Anniversary – Celebrating 40 Years of Transformational Growth

The Cahya Mata story began in 1974 with the company working to establish the first cement plant in Sarawak. In the 40 years since then, Cahya Mata has transformed into one of Sarawak’s and Malaysia’s leading listed companies with a synergistic portfolio of businesses strongly focused on Sarawak and the economic opportunities arising from the Sarawak Corridor of Renewable Energy (SCORE). This has occurred in tandem with Sarawak’s own transformation from a State very visibly lagging behind the states of Peninsular Malaysia in terms of development into a State with exciting potential for growth – fuelled by its abundant and largely renewable energy resources, its people, its location and its proactive and stable leadership. Over the course of Cahya Mata’ 40-year history, it has achieved many milestones, and played a key role in Sarawak’s physical and economic development. The Cahya Mata 40th Anniversary coffee table book, which was launched at the Cahya Mata 40th Anniversary Celebration Dinner on 26 November 2014, provides fascinating insights into the rise of Cahya Mata and the development of the State of Sarawak in tandem with the growth of the Malaysian economy.

Watch Video -

Cahya Mata increased stake in OM Sarawak Project

On 26 March 2015, Cahya Mata announced that its wholly-owned subsidiary, Samalaju Industries Sdn Bhd (SISB), entered into a Share Sale Agreement with OM Materials (S) Pte. Ltd. (OMS) for the purchase of an additional 5% equity interest in the Ferrosilicon and Manganese alloys smelting project in Samalaju Industrial Park (SIP). Under the terms of the Share Sale Agreement, the consideration payable by SISB to OMS for this transfer was USD18.45 million and Cahya Mata’ effective interest in the project is 25%; OMS’s effective interest is 75%. The purchase of the additional equity interest reflected Cahya Mata’ special focus in businesses that are part of the Sarawak Corridor of Renewable Energy (SCORE), and the Group’s confidence in this smelting project.

-

Malaysian Phosphate Additives (Sarawak) inked PPA with Sarawak Energy Berhad

Malaysian Phosphate Additives (Sarawak) Sdn Bhd signed a Power Purchase Agreement (PPA) with Sarawak Energy Berhad to power the largest integrated phosphate additives plant in South East Asia. Located in Samalaju Industrial Park, the plant will have an annual production capacity of approximately 500,000 MT of food, feed and fertiliser phosphate additives, 100,000 MT of ammonia and 900,000 MT of coke. Production ramp up is scheduled to commence in the first half of 2018.

PPES Works (Sarawak) signed with the Sarawak Government for the Datuk Temenggong Abang Kipali bin Abang Akip Interchange

A contract signing ceremony was held between PPES Works (Sarawak) Sdn Bhd and the Sarawak Government for the proposed construction of the Datuk Temenggong Abang Kipali bin Abang Akip Interchange via the shallow underpass to ease traffic congestion. The scope of works includes the design, construction, completion and commissioning of the Kipali Interchange, underpasses structure, drainage and ancillary works. The RM67.0 million Design & Build Contract was awarded on 26 October 2015. Construction period is expected to take 24 months.

SACOFA entered into agreement with U Mobile

SACOFA Sdn Bhd signed an Infrasharing & Bandwidth Leasing Agreement with U Mobile Sdn Bhd to deliver built-to-suit sites and provide bandwidth leasing services to U Mobile Sdn Bhd over a period of 10 years. The contract value for the towers is RM2.70 million per annum and for the fibre-leased line at RM1.30 million per annum. Cahya Mata has a 50% equity stake in SACOFA.

Malaysian Phosphate Additives (Sarawak) signed EPC Contract with China Contractors

Malaysian Phosphate Additives (Sarawak) Sdn Bhd signed an Engineering Design, Procurement and Construction (EPC) Contract with a consortium of contractors from China to build a RM2.20 billion integrated phosphate complex at Samalaju Industrial Park in Bintulu, Sarawak. The plant is expected to commence in Q1 2018 and set for completion at end-2018.

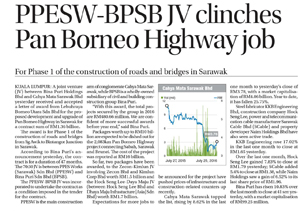

PPESW BPSB JV clinched Pan Borneo Highway job

PPES Works (Sarawak) Sdn Bhd accepted a Letter of Award from Lebuhraya Borneo Utara Sdn Bhd for the Proposed Development & Upgrading of Pan Borneo Highway in Sarawak. PPES Works (Sarawak) signed a 70:30 Joint Venture with Bina Puri Sdn Bhd for Phase 1 of Work Package Contract (WPC) 06 for a contract sum of RM1.358 billion. WPC 06 stretches from Sg. Awik Bridge to Bintangor Junction (64.486km) is set for the duration of 47 months ending on 31 August 2020.

Signing Ceremony between Cahya Mata Infra Trading and IPV Distributors

Cahya Mata Infra Trading Sdn Bhd signed an Exclusive Agency Agreement with IPV Distributors Sdn Bhd for the supply, delivery, installation and commissioning of IPVLED® (Heavy Duty LED) in Sarawak on 22 August 2016. The Agency Agreement aims to establish, develop and optimise the Heavy Duty LED lighting business in Sarawak and Sabah especially in the niche market such as High Mast, High Bay, stadiums and street lightings, as these are the areas many LED manufacturers will not be able to compete with its product capabilities.

Samalaju Resort Hotel Opening Marked New Era for SCORE

Samalaju Properties Sdn Bhd officially opened its Samalaju Resort Hotel located within the Samalaju Industrial Park (SIP) on 18 October 2016. The opening of the 23-acre hotel and resort attributes to a major milestone for Samalaju and Sarawak Corridor of Renewable Energy (SCORE). Strategically located within the SIP, the 175-room business cum leisure resort is targeted at both short-term and longer-term guests who are seeking accessibility, convenience amidst an ‘oasis of tranquillity’.

Samalaju Properties signed two special agreements

On 18 October 2016, Samalaju Properties Sdn Bhd signed an agreement with the Trustees of the Methodist Church in Sarawak to buy 10 acres of land to build a school and a Memorandum of Understanding with PMB Development Sdn Bhd to consider the leasing of apartment units completed by Samalaju Properties Sdn Bhd in Samalaju Eco Park.

Official Launch of East Malaysia’s First Integrated Cement Plant

Cahya Mata launched East Malaysia's first integrated cement plant at Cahya Mata Clinker plant in Mambong, Kuching. The 1 million-MT plant was built at a sum of RM190.0 million and is Cahya Mata' third and largest cement grinding plant. The Engineering, Procurement and Construction contract for this plant was awarded to Christian Pfeiffer Maschinenfabrik GmbH, a leading German company in this sector, in April 2014. Construction began in July 2014, production ramp up commenced in December 2015 and it was fully commissioned earlier of 2016.

Cahya Mata Clinker signed MoU with ZHA Environmental

Cahya Mata Clinker Sdn Bhd signed a Memorandum of Understanding (MoU) with ZHA Environmental Sdn Bhd to enter into negotiations for the use of shredded rubber tyres as an alternate fuel in the production of clinker. The objective of this MoU is consistent with Cahya Mata’ commitment towards its sustainability programme.

Launching of WPC 06 of Pan Borneo Highway

Work Package Contract (WPC) 06 of the Pan Borneo Highway was officially launched by the Prime Minister YAB Datuk Patinggi Najib Tun Razak in Miri, Sarawak. WPC 06 is managed by PPESW BPSB JV Sdn Bhd for the stretch of road from Sg. Awik Bridge to Bintangor Junction (64.486km). The RM16.59 billion-Pan Borneo Highway which was officially launched by Datuk Patinggi Najib on 31 March 2015 in Bintulu, will cover a total distance of 1,089km from Telok Melano to Merapok, Sarawak.

-

Cahya Mata Pavement Tech collaborated with Lebuhraya Borneo Utara and Wirtgen (M)

Cahya Mata Pavement Tech Sdn Bhd collaborated with Lebuhraya Borneo Utara Sdn Bhd and Wirtgen (M) Sdn Bhd to provide improved solutions on road construction processes using a laying machine (paver) through water jet and pressure bars.

Sarawak Minister YB Datuk Abdul Karim Rahman Hamzah visited the new Sarawak Museum Campus

Sarawak Minister for Tourism, Arts, Culture, Youth and Sports, YB Datuk Abdul Karim Rahman Hamzah visited the new Sarawak Museum Campus project site. Project cost is RM308.0 million and is scheduled for completion in January 2020.

Appointment of Dato Isaac Lugun and Mr Goh Chii Bing as Group Chief Corporate Officer and Group Chief Operating Officer

Dato Isaac Lugun and Mr Goh Chii Bing were appointed as Group Chief Corporate Officer and Group Chief Operating Officer respectively effective 1 August 2017. These appointments were made following the impending retirement of Dato’ Richard Curtis on 31 December 2017. On 1 January 2018, Dato Isaac’s and Mr Goh’s positions were re-designated as Group Chief Executive Officer - Corporate and Group Chief Executive Officer - Operations respectively....

LCDA Headquarter building achieved practical completion

The Land Custody and Development Authority (LCDA) Headquarter building achieved practical completion on 31 July 2017. This GBI-certified 11-storey office tower was built under a Design and Build and Negotiated Contract by Cahya Mata Land Sdn Bhd at a cost of RM 66.0 million and it is one of the two Gateway Towers at The Isthmus.

Official Opening of the Darul Hana Bridge by His Excellency The Governor of Sarawak

The Darul Hana Bridge was officially opened by His Excellency The Governor of Sarawak, Tun Pehin Sri Haji Abdul Taib Mahmud. This RM35.0 million project was implemented by the Sarawak Economic Development Corporation for the State Government of Sarawak and the turnkey contract was awarded to the consortium of PPES Works (Sarawak) Sdn Bhd and Naim Land Sdn Bhd.

Cahya Mata Education entered into a Management Agreement with HELP Education Services

Cahya Mata Education Sdn Bhd entered into a Management Agreement with HELP Education Services Sdn Bhd. This partnership is aimed at delivering excellent academic performance and good quality education by capitalising on the school’s existing holistic learning approach. Cahya Mata Education Sdn Bhd oversees Tunku Putra School.

Signing of the Design and Build and Negotiated Contract of the Miri-Marudi road rehabilitation project

The Design and Build and Negotiated Contract of the proposed 43km Miri-Marudi road rehabilitation project was signed. The construction period is 30 months and is scheduled for completion by 15 March 2019.

Retirement of Dato’ Richard Curtis and Re-designations of Dato Isaac Lugun and Mr Goh Chii Bing

Cahya Mata announced the retirement of Dato’ Richard Curtis as Group Managing Director on 31 December 2017 and re-designations of Dato Isaac Lugun as Group Chief Executive Officer – Corporate and Mr Goh Chii Bing as Group Chief Executive Officer – Operations.

-

Cahya Mata, Ibraco & HELP Education Group signed Memorandum of Understanding

Cahya Mata, Ibraco Berhad and the HELP Education Group signed a Memorandum of Understanding to announce their partnership in establishing the Tunku Putra-HELP International School (TPHIS) on 9 March 2018. The new purpose-built campus which will have a capacity of 1,500 students, promises to deliver world-class education and state-of-the-art facilities at affordable fees. Located in the NorthBank, Tabuan Jaya, TPHIS will offer both national and international curricula for students from Kindergarten to A-Levels, and will begin its first intake in January 2020.

Opening of the Kipali Shallow Underpass

The RM67.0 million Kipali Shallow Underpass was opened to the public on 14 June 2018. The RM67.0 million Design & Build Contract was awarded to PPES Works (Sarawak) Sdn Bhd on 26 October 2015.

Cahya Mata grabbed Silver at the 2018 ARA

Cahya Mata received the Silver Award at the 2018 Australasian Reporting Awards (ARA) for the Cahya Mata Annual Report 2016. ARA provides organisations that produce annual reports the opportunity to benchmark against world best practice. Cahya Mata was among the few companies in the region who met the high standards set by ARA.

Sarawak Museum Campus achieved Safety Milestone

The Sarawak Museum Campus & Heritage Trail project marked its safety milestone with an achievement of more than 1,000,000 man-hours without injury. This shows the project team’s consistent and uncompromising commitment to a safe work culture by focusing on the company’s stringent safety rules, backed by a strong and visible leadership from line management. The relevant authorities continue to ensure that health and safety rules and regulations are not only met but exceeded. PPES Works (Sarawak) Sdn Bhd was awarded the Design and Build and Negotiated Contract of the Sarawak Museum Campus & Heritage Trail on 14 April 2015. The RM308.0 million project is scheduled for visitation in 2020.

Cahya Mata and IEM (Sarawak Branch) signed a Memorandum of Understanding

Cahya Mata and The Institution of Engineers, Malaysia (Sarawak Branch) signed a Memorandum of Understanding (MoU) to establish collaborative relations between the two parties in developing technical interchange. It is the first step in establishing a collaborative relationship which includes research, training and exchange of information between the two parties. The signing of the MoU was witnessed by YB Tan Sri Datuk Amar Dr. James Jemut Anak Masing, Sarawak Deputy Chief Minister and Minister for Infrastructure Development and Transportation.

CIPR Technology with Lebuhraya Borneo Utara Sdn Bhd and Wirtgen (M) Sdn Bhd

Cahya Mata Pavement Tech Sdn Bhd held a 1-day seminar on “Cold in Place Pavement Recycling (CIPR) Technology” in collaboration with Lebuhraya Borneo Utara Sdn Bhd and Wirtgen (M) Sdn Bhd which was organised by the Institution of Engineers, Malaysia (Sarawak Branch). The seminar provided a 2-pronged collaborative platform to discuss and determine firm strategies to enhance the State’s road management and maintenance approach. It also discussed potential solutions to the construction process and quality of road using CIPR and how CIPR solutions can be implemented via in-place methods such as Ordinary Portland Cement, lime and bitumen, which are useful in the construction of the Sarawak Pan Borneo Highway.

Memorandum of Agreement signed between Cahya Mata Cement Industries & UNIMAS

Cahya Mata Cement Industries Sdn Bhd signed a Memorandum of Agreement with UNIMAS Holdings Sdn Bhd at the International UNIMAS STEM 11th Engineering Conference 2018 to carry out Research & Development on the properties of concrete made from Portland Limestone Cement and Portland Composite Cement.

Appointment of new Group Chairman

Cahya Mata announced the appointment of Y Bhg Tan Sri Abdul Rashid Bin Abdul Manaf as Group Chairman on 1 October 2018.

Handing over of keys to UCSI

Cahya Mata Land Sdn Bhd handed over the keys of 18 units of two blocks strata titled 3-storey commercial shophouses at Raintree Square, The Isthmus, to UCSI Peterson Properties Sdn Bhd. The ceremony was held on 11 October 2018.

YB Datuk Karim visited Sarawak Museum Campus

Sarawak Minister for Tourism, Arts, Culture, Youth and Sports, YB Datuk Abdul Karim Rahman Hamzah visited the new Sarawak Museum Campus project site on 26 October 2018. The project which costs RM308.0 million was awarded to PPES Works (Sarawak) Sdn Bhd on a Build and Negotiated Contract on 14 April 2015 and is scheduled for visitation in 2020. The project also marked its safety milestone with an achievement of more than 1,000,000 man-hours without injury on 29 June 2018.

Cahya Mata launched its new eco-friendly PLC

Cahya Mata launched its new eco-friendly Portland Limestone Cement (PLC) 32.5N on 9 November 2018. Taking almost two years to develop, the PLC is an eco-friendly product, manufactured by grinding a special blend of clinker, gypsum and high-quality limestone under stringent quality control, and ground to a higher fineness resulting in better water retention, cohesiveness and higher workability in mortar and concrete. It is targeted for low-rise concrete structures, plastering and bricklaying, and construction of drains and rural or kampung roads.

Cahya Mata Cement Industries Sdn Bhd awarded Gold for the 8th CMEA 2017/2018

Cahya Mata Cement Industries Sdn Bhd was awarded the Gold Award for the 8th Chief Minister Environmental Award 2017/2018 under the Large Enterprise (Manufacturing) category. This prestigious Environmental Award (CMEA) is the highest environmental initiatives recognition award bestowed to the public sectors, businesses and industries in Sarawak, in recognising the environmental efforts and commitment of industries which demonstrate exemplary stewardship towards the protection and preservation of our environment. Our commitment to minimise the impact on the environment through the practice of sustainability initiatives such as exploring Alternative Raw Materials and Alternative Fuel in clinker and cement manufacturing, 4R (Reduce, Reuse, Recycle & Recover), implementation of DOE Guided Self-Regulations (GSR), community engagement initiatives and going beyond ISO 14001 Environmental Management Systems and ISO 5001 Energy Management Systems have secured us this award despite the fact that it was our first time participating in this environmental award! The CMEA is a premier State environmental award jointly organised biennially by Natural Resources and Environment Board, Sarawak and Sarawak Business Federation.