MEDIA STATEMENT

CAHYA MATA REPORTS STRONG FINANCIAL PERFORMANCE

FOR NINE MONTHS OF 2024

Nornalized PBT of RM147.6 Million Reflects Significant Growth Trajectory

Kuching (Sarawak), Tuesday, 26 November 2024 – Cahya Mata Sarawak Berhad ("Cahya Mata" or "the Group") is pleased to announce its financial results for the nine months ended 30 September 2024 (“PE2024”). Following challenging market conditions in the first half of the year, the Group achieved a significant turnaround in the third quarter (Q3 2024). Revenue for Q3 2024 rose by 8% to RM299.9 million, a substantial increase from RM278.0 million in Q2 2024, driven by improved performance in the Cement and Road Maintenance Divisions.

In Q3 2024, the market saw the strengthening of the Malaysian Ringgit (RM) against US Dollar (USD), with exchange rates at 4.11 as of 30 September 2024, compared to 4.72 on 30 June 2024, resulting in an unrealized forex loss incurred by Cahya Mata Phosphates Sdn Bhd (Cahya Mata Phosphates) which operates with a USD functional currency while holding RM-denominated shareholder loans.

This also led to the Group reporting a loss before tax (LBT) of RM23.4 million for Q3 2024, compared to a profit before tax (PBT) of RM50.3 million for Q2 2024. It is important to note that this result was significantly impacted by an unrealized foreign exchange (forex) loss of RM74.9 million due to the revaluation of shareholder loans to Cahya Mata Phosphates. Excluding this unrealized forex loss, the normalized PBT for Q3 2024 is estimated to be RM51.5 million, in contrast to the LBT reported by the Group.

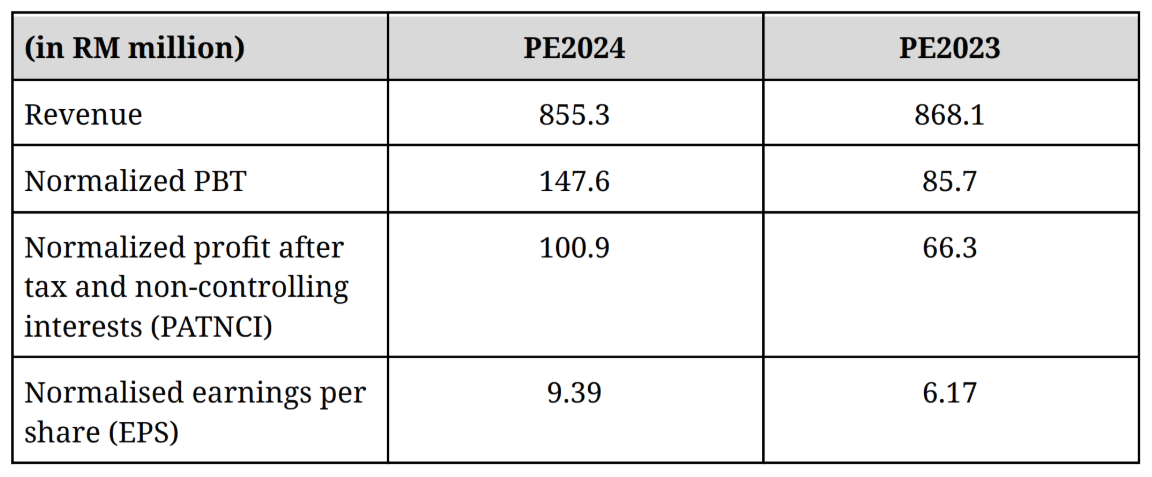

For the nine-month period, the Group recorded total revenue of RM855.3 million and a PBT of RM84.2 million. The normalized PBT of RM147.6 million for PE2024 represents a remarkable increase of 72.1% compared to the normalized PBT of RM85.7 million for the nine months ending 30 September 2023 (PE2023). We believe that the normalized profit for PE2024 more accurately reflects our operational performance for the period.

Operationally, our core divisions demonstrated improved performance over the first nine months of 2024, highlighting the Group's enhanced profitability and effective cost management strategies. Cahya Mata continues to showcase strong financial resilience, with Net Tangible Assets (NTA) per share at RM3.02 and Net Assets per share at RM3.09, reflecting a robust asset base and solid equity position. Our Gearing Ratio remains low at 7.4%, underscoring our prudent leverage approach and strong balance sheet management. Additionally, the Group maintains a solid cash position of RM434.6 million in PE2024, demonstrating our commitment to sustaining a strong financial foundation while driving operational efficiencies and sustainable growth across our diverse portfolio of businesses.

Key Highlights of Normalized Results for PE2024 vs PE2023:

Business Segments' Performance

(a) Cement Division - reported a higher PBT of RM108.5 million in PE2024 despite a lower revenue of RM471.9 million, 20% higher PBT of RM90.5 million and 4% lower over PE2023's revenue of RM493.9 million. The lower revenue was consistent with the drop in sales volume mainly attributable to slow construction activities resulting from prolonged rainy season in Sarawak especially in the first half of the year. The improved profitability of the division was mainly due to improved gross profit margin attributable by the lower imported clinker prices and improved efficiencies.

(b) Road Maintenance Division - reported a higher revenue of RM92.2 million and PBT of RM11.0 million, 24% higher over PE2023's revenue of RM74.5 million and 116% higher over PBT of RM5.1 million. Higher PBT was in line with higher revenue from road maintenance, third party and instructed works coupled with increased gross profit margin recorded in PE2024.

(c) Property Development Division - reported a lower revenue of RM30.9 million and PBT of RM3.0 million in PE2024, 30% lower over PE2023's revenue of RM44.2 million and 54% lower PBT of RM6.7 million. Lower PBT was mainly due to slower sales of properties.

(d) Phosphates Division - Loss before tax of RM125.4 million was recorded for PE2024, higher than PE2023 loss of RM99.1 million. This was mainly attributable to the strengthening of the RM against the USD, which gave rise to the unrealised foreign exchange losses, despite lower operating costs incurred in PE 2024.

(e) Oiltools Division - reported a higher revenue of RM219.3 million and PBT of RM37.5 million in PE2024, 4% higher over PE2023's revenue of RM211.5 million and 45% higher PBT of RM25.8 million. The increase in revenue and profitability was driven by strong performance in Indonesia and UAE coupled with improvement in gross profit margin.

Prospects

According to the Group, "Cahya Mata Sarawak Berhad remains optimistic about the outlook for 2024, notwithstanding certain challenges. We expect cement demand to strengthen, driven by significant infrastructure projects announced by the State Government, thereby enhancing the Group's overall prospects. However, we recognize that broader economic volatility may persist due to inflationary pressures and supply chain disruptions stemming from global geopolitical uncertainties."

To effectively navigate this landscape, the Group is dedicated to improving operational, logistics, and distribution efficiencies. We aim to seize emerging opportunities that align with our strategic objectives while fostering innovation and sustainability across our operations. By prioritizing stakeholder engagement and consistently delivering value, we are committed to strengthening our market presence and driving long-term profitability for our shareholders, all while making a positive impact on the communities we serve.

-END-